Yemen Conflict Observatory

// Regional Profile

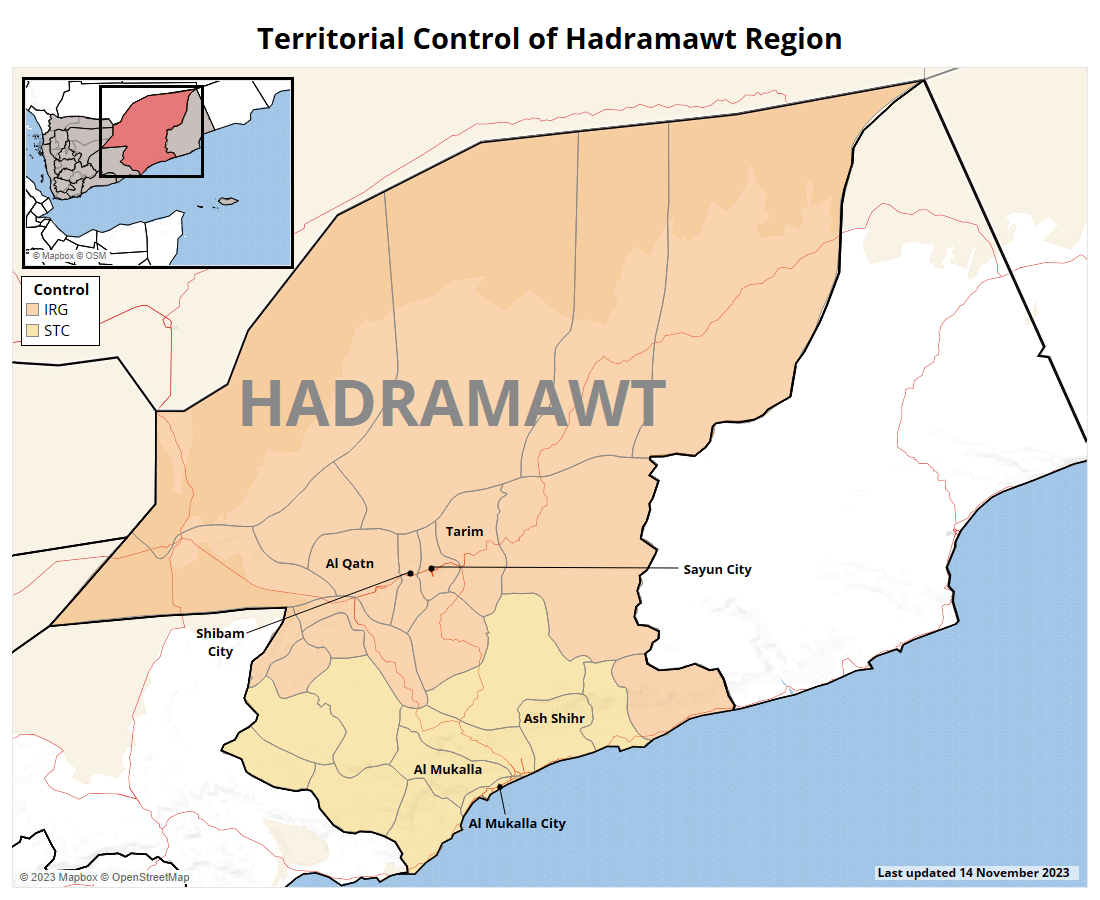

Hadramawt

Updated: 31 January 2024

More information

- Methodology

Territorial Control Maps

Territorial control maps are generated through the expert assessment of the Yemen Conflict Observatory (YCO) team and they are updated on a quarterly basis. ‘Contested areas’ are defined on the district level (Admin2) and encompass active frontlines and territories disputed by the warring parties. Each map corresponds to a 'region' as defined by the YCO, potentially crossing governorate (Admin1) boundaries.

Links

Find links to relevant methodology docs below:

Coding decisions around the Yemen war

- A brief overview of ACLED’s coding and sourcing methodology for Yemen

- A brief overview of the most frequently asked questions by users of ACLED data

- Guides for using and accessing ACLED data and documentation for ACLED’s core methodology

This regional profile provides information about the Hadramawt governorate. For more on the YCO and the ACLED methodology on Yemen, see the ‘More information’ tab to the right.

Overview

Hadramawt is located in the east of Yemen and is the largest governorate in Yemen, constituting over a third of the country’s total landmass. Bordered by Saudi Arabia to the north and the Arabian Sea to the south, Hadramawt is one of Yemen’s richest governorates, with a wealth of natural resources, including oil and gas. In addition to these hydrocarbon reserves, it also contains critical infrastructure with the commercial port of al-Mukalla and al-Shihr oil terminal on the south coast and al-Wadia crossing in the northwest leading into Saudi Arabia, the only land port that has remained open between the two countries since the start of the current conflict.

Administratively, the governorate comprises 28 districts, which have been informally divided between two distinct centers of power with different military loyalties and external backing. Hadramawt al-Sahil – coastal Hadramawt – in the south includes the capital of al-Mukalla and is home to the commercial and oil export ports of al-Mukalla and al-Shihr, as well as key energy infrastructure. The Emirati-backed Hadrami Elite Forces control this area.1United Nations Panel of Experts for Yemen, ‘Final report of the Panel of Experts in accordance with paragraph 6 of resolution 2342 (2017),’ 26 January 2018, p. 19 Hadramawt al-Wadi and al-Sahra – Hadramawt valley and desert – cover the center and north of the governorate through which key international routes connecting to neighboring Saudi Arabia and Oman run. The area falls under the First Military Region, the Sayun city-based commanding military division led by officers with long-standing ties to the Islamist Islah party and loyal to the Internationally Recognized Government (IRG).

Similar to the military divisions between the two parts of the governorate, Hadramawt is also politically divided. Coastal Hadramawt is de facto ruled by the Southern Transitional Council (STC), although Governor Mabkhut bin Madhi maintains ties to the IRG. His predecessor, Faraj al-Bahsani – who still holds significant sway in the governorate – officially joined the STC after being replaced in July 2022. In central Wadi Hadramawt, the First Military Region holds sway. Its dominance has caused resentment among locals, some of whom perceive it as an occupying force due to a number of their soldiers coming from northern governorates.2Al-Masdar, ‘Protesters loyal to the transitional council block streets in Seiyun to demand the evacuation of army forces from the city,’ 5 March 2019

Interactive Map

This dashboard includes political violence events recorded within this YCO-defined region since the start of the regional conflict on 26 March 2015. By default, the map displays data for the period beginning with the UN-mediated truce, on 2 April 2022, up to the most recent week.

Filters on the left allow users to define a time range and analyze trends in more detail. The toggle at the bottom of the dashboard activates markers indicating relevant infrastructure such as oil fields, airports, and military camps.

Conflict background

Unlike much of the rest of the country, Hadramawt has been spared from Houthi incursions. However, although it has been one of the most stable governorates, it has still experienced elevated insecurity as the conflict has resulted in a decline in the central government’s authority, and internal tensions have risen as competing political factions have sought to fill the vacuum.

Exploiting the security breakdown at the start of the war, al-Qaeda in the Arabian Peninsula (AQAP) took over the governorate capital of al-Mukalla in April 2015, holding the city for a year before being ousted by an Emirati-backed offensive. Taking advantage of the IRG and Saudi-led Coalition pre-occupation with Houthi advances in the center and west of the country, AQAP captured al-Mukalla without a fight. It released 150 fighters from the central prison, including current AQAP Emir Khalid Batarfi, and looted millions from the Central Bank branch. AQAP managed to run the city as a quasi-state for an entire year, delivering basic services and infrastructure projects while collecting customs fees.3Elizabeth Kendall, ‘Contemporary Jihadi Militancy In Yemen How Is The Threat Evolving?,’ Middle East Institute, July 2018, p.8 After reversing the Houthis’ gains in Aden, the United Arab Emirates turned its attention to al-Mukalla, building an alliance of tribal fighters and local troops under Faraj al-Bahsani, a long-exiled military leader convinced by the UAE to return after 20 years, to retake the city.4Adam Baron, ‘The Gulf Country That Will Shape the Future of Yemen,’ The Atlantic, 22 September 2018 Supported by Emirati ground and air forces, it swiftly removed AQAP in just a few days in April 2016. The minimal fighting and lack of casualties, though, sparked rumors of an arrangement between the UAE and militants for their withdrawal and relocation to other parts of the country,5Michael Horton, ‘AQAP in Southern Yemen: Learning, Adapting and Growing,’ The Jamestown Foundation, 14 October 2016 which Abu Dhabi has repeatedly denied.6Maggie Michael, Trish Wilson, and Lee Keath, ‘US allies, al-Qaida battle rebels in Yemen,’ Associated Press, 7 August 2018

The Hadrami Elite Forces, trained and equipped by the UAE, have since largely replaced regular forces in the coastal areas of Hadramawt. They have also gradually extended their areas of operation to the inner regions of Hadramawt, fueling tensions within the governorate. Initially, they clashed with AQAP militants in the districts surrounding al-Mukalla, mounting a series of campaigns to clear the south of the governorate, ending when they reached the borders of Wadi Hadramawt in May 2018.

Since then, targeted attacks and assassinations have been the primary types of security incidents, mainly in central Wadi Hadramawt in Sayun and Shibam districts. STC-affiliated figures and groups have blamed these on the failures of the Islah-leaning First Military Region, calling for their replacement with locally recruited units along the lines of the Hadrami Elite.7Ali Mahmood, ‘Yemenis in Hadramawt demand UAE-backed forces take over security,’ The National, 26 July 2018 This refrain has been a consistent demand for local groups; most prominently, the Hadramawt Tribal Confederation – the largest tribal grouping in the governorate who have held frequent protests calling for greater autonomy and control over resources.

The protests have grown in size and frequency, driven not only by the political tensions, but also the worsening economic conditions as public services have broken down. The local authorities deflected blame onto the IRG for failing to deliver revenues, though the protests expanded into organized unrest targeting the governorate’s economic infrastructure through strike actions, roadblocks, and sit-ins disrupting oil production and commercial activity. Although mainly peaceful, the increasingly politicized nature of the demonstrations, which gained backing from the STC and former Governor Bahsani, often resulted in a hard-handed response from the First Military Region.

The economic pressures increased in late 2022 when the Houthis forced the shutdown of oil production in the country, cutting off the governorates and IRG’s main source of revenue. Houthi drones struck the al-Dahbba oil terminal on 21 October and 21 November as oil tankers were preparing to load crude oil, damaging the facility, but not any of the docked vessels. The group has threatened more attacks if oil exports resume, demanding a share of hydrocarbon revenues to pay for public-sector salaries. The shortfall in government income has exacerbated the political divisions and civil unrest.

The political tensions continue to mount in 2023 between the IRG and STC in Hadramawt. As the STC continues to try to expand its influence in the governorate as part of its aim to control the territory of the former South Yemen, Saudi Arabia – which has its strategic interests in the governorate8Sana’a Centre for Strategic Studies, ‘Saudi-UAE Spat Comes to a Head in Hadramawt,’ 15 August 2023 – invited influential Hadrami political and tribal figures to Riyadh for consultations with Hadramawt Governor bin Mabkhut bin Madhi. The meetings resulted in the formation of a new, Saudi-backed Hadramawt National Council with a platform of greater autonomy for the governorate, but in a national framework as opposed to the STC’s goal of southern secession.9Mansour Al-Maswari, ‘New Yemeni entity established in Saudi Arabia’, Al-Bawaba, 21 June 2023

The establishment of the new party was followed by the announcement of a host of Saudi-funded development projects in Hadramawt and the first visit by Saudi-aligned Presidential Leadership Council (PLC) chief Rashad al-Alimi, who also pledged greater decentralization as part of a federal approach.10Middle East Monitor, ‘Saudi launches $320m developmental projects in Yemen’s Hadramout,’ 26 June 2023 The moves drew strong criticism from the STC, and the governorate remains a point of political contestation between national and regional rivals.11Yasser Ezzi, ‘Hadramawt National Council: A new player in Yemen’s political landscape,’ The New Arab, 26 June 2023 The newly formed, Saudi-backed Nation’s Shield Forces (NSF) were subsequently deployed to Wadi Hadramawt in October 2023 to serve as a buffer between the First Military Region, which is aligned with Islah, and Second Military Region, which is aligned with the STC. The NSF are under the direct command of PLC chairman Rashad al-Alimi.

Timeline

- 2015

- Apr. | AQAP takes over the governorate capital of al-Mukalla

- 2016

- Apr. | Local forces backed by the UAE retake al-Mukalla from AQAP

- The UAE establishes the Hadrami Elite Forces

- 2018

- May | Hadrami Elite counter-terrorism campaigns clear AQAP from most of coastal Hadramawt

- 2022

- Oct. & Nov. | Houthi drones strike the Ad Dhabba terminal, shutting down all oil production

- 2023

- Jun. | Saudi Arabia and the IRG form the Saudi-backed Hadramawt National Council to counter growing STC influence

- Oct. | Saudi-backed Nation’s Shield Forces deployed to Wadi Hadramawt, purportedly to serve as a buffer between rival parties in the governorate

Regional Context

Hadramawt is one of Yemen’s richest governorates, with a wealth of natural resources, including oil and gas. There are two main seaports in the governorate, the international port of al-Mukalla and the al-Dahbba oil port in al-Shihr district, which is used to export crude oil from al-Masilah fields. Before the escalation of the conflict in 2015, Hadramawt had the capacity to produce an estimated 104,000 barrels per day (BPD) from seven different oil fields. Production was significantly diminished by the onset of the war, but had reached around 80,000 BPD by 2022. Any output, though, was ended by the Houthi attacks on al-Dahbba, as well as on al-Nushayma in neighboring Shabwa, and has yet to resume.

The governorate also contains several critical transport routes, including the two international roads: the al-Abr route connects Hadramawt to Saudi Arabia and the Aqabat Ishash route links Hadramawt and Oman via al-Mahra. Both are vital arteries for the supply chain to IRG-held territory, bringing goods overland from the two Gulf states, as well as exporting goods to the neighboring countries. The al-Wadiah border crossing from al-Abr district into Saudi Arabia is the only open entry point from Yemen since the start of the current conflict. This border crossing is held by IRG forces connected to the First Military Region and serves as a key source of revenue.