Yemen Conflict Observatory

// Regional Profile

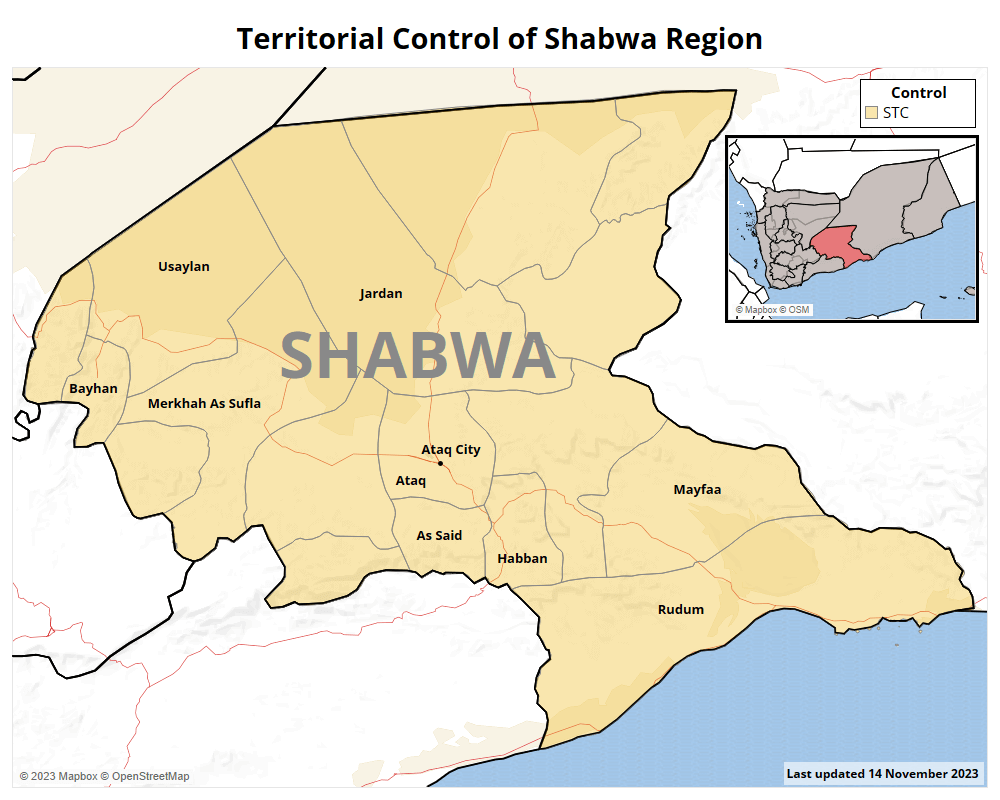

Shabwa

Updated: 31 January 2024

More information

- Methodology

Territorial Control Maps

Territorial control maps are generated through the expert assessment of the Yemen Conflict Observatory (YCO) team and they are updated on a quarterly basis. ‘Contested areas’ are defined on the district level (Admin2) and encompass active frontlines and territories disputed by the warring parties. Each map corresponds to a 'region' as defined by the YCO, potentially crossing governorate (Admin1) boundaries.

Links

Find links to relevant methodology docs below:

Coding decisions around the Yemen war

- A brief overview of ACLED’s coding and sourcing methodology for Yemen

- A brief overview of the most frequently asked questions by users of ACLED data

- Guides for using and accessing ACLED data and documentation for ACLED’s core methodology

This regional profile provides information about the Shabwa governorate. For more on the YCO and the ACLED methodology on Yemen, see the ‘More information’ tab to the right.

Overview

Located in the center of southern Yemen, Shabwa stretches from the foot of the country’s mountainous highlands to the coastal plains of the Gulf of Aden. The governorate is the third largest in the country after its eastern neighbors of Hadramawt and al-Mahra, while Marib flanks it to the north and Abyan and al-Bayda to the west. Despite its size, Shabwa is one of the least populated governorates in the country, with an estimated 600,000 to 700,000 residents.

Despite its sparse population, Shabwa has gained comparatively greater revenues and autonomy from the central government due to its hydrocarbon wealth, similar to its resource-rich neighbors in Marib and Hadramawt. The governorate is one of Yemen’s main oil-producing regions, and contains critical pipelines and infrastructure central to the functioning of the country’s hydrocarbon exports, most notably the Balhaf Liquified Natural Gas (LNG) terminal, the largest foreign industrial investment in Yemen’s history.1Nabih Bulos, ‘Yemen is collapsing. That may be its salvation’, Los Angeles Times, 15 December 2020

Shabwa became the first governorate to resume oil production in 2018 after exports were halted in 2014 due to the onset of the current conflict. However, operations were shuttered once again in late 2022 after Houthi drone attacks targeted oil terminals on the south coast, forcing a halt to exports. The governorate has been on the periphery of the broader conflict in recent years, but has experienced several periods of intensive fighting since 2015 as conflicting political agendas have escalated into armed violence.

The Southern Transitional Council (STC), backed by the United Arab Emirates, has been ascendant in the governorate since the end of 2021 when current Governor Awad al-Awlaqi replaced Governor Muhammad bin Adyu – affiliated with the Islamist Islah party – as a precondition for the UAE-supported Giants Brigades to enter Shabwa and mount a counter-offensive against the encroaching Houthis.2Gregory D. Johnson, ‘Shabwa and Cracks in the Foundation of Yemen’s Presidential Leadership Council,’ The Arab Gulf States Institute, 19 August 2022 Islah loyalists still maintained some positions of power, but this was decisively ended during a brief battle with UAE-supported Giants Brigades and Shabwani Defence Forces (SDF) over the governorate capital of Ataq in August 2022.3Reuters, ‘Clashes in oil-rich Shabwa test Yemen’s new presidential council,’ 11 August 2022

Interactive Map

This dashboard includes political violence events recorded within this YCO-defined region since the start of the regional conflict on 26 March 2015. By default, the map displays data for the period beginning with the UN-mediated truce, on 2 April 2022, up to the most recent week.

Filters on the left allow users to define a time range and analyze trends in more detail. The toggle at the bottom of the dashboard activates markers indicating relevant infrastructure such as oil fields, airports, and military camps.

Conflict background

Early in the conflict, Shabwa was on the frontlines of the conflict between Houthi-Saleh forces and the Internationally Recognized Government (IRG). The governorate had been a stronghold for then-president Tariq Saleh’s party, the General People’s Congress (GPC), and the support from co-opted local tribes and elites facilitated their rapid advance from the north of the governorate to the capital of Ataq by April 2015. However, their gains were short-lived, and pro-IRG troops retook Ataq just four months later, pushing the Houthi-Saleh forces back to the northern border with Marib. They managed to hold onto the Wadi Bayhan area, consisting of Bayhan, Usaylan, and al-Ain districts, for over two years, in part due to its strategic importance as a gateway to surrounding governorates, the proximity of the Balhaf pipeline, and lucrative smuggling routes.4Peter Salisbury, ‘National Chaos, Local Order,’ Chatham House, December 2017 Their resistance, though, crumbled shortly after the breakdown in the alliance, and the killing of Tariq Saleh in December 2017 led to local tribes ending their support.

In addition to the civil war, Shabwa has also been the site of long-running al-Qaeda in the Arabian Peninsula (AQAP) activity. Exploiting the conflict, AQAP militants captured the southern towns of Habban and Azzan in February 2016. However, starting in late 2016, the UAE’s recruitment and training of the Shabwa Elite Forces (SEF) from local tribes in areas where AQAP was operating began to prove effective in weakening the militant group.5Hussam Radman, ‘Al-Qaeda’s Strategic Retreat in Yemen,’ Sana’a Centre for Strategic Studies, 17 April 2019, p. 11 Working in coordination with Emirati and United States counter-terrorism forces, including drone and airstrikes, the SEF advanced through the center of the governorate, eventually chasing AQAP into neighboring al-Bayda by mid-2018.

The SEF’s expansion from the south into the center of the governorate created friction with IRG-aligned forces and the Islamist Islah party-affiliated Governor, Muhammad bin Adyu, not only due to their perceived territorial overreach but also due to their increasingly evident support for the secessionist STC. The antagonism between the sides reached a tipping point in the summer of 2019. A dispute between the SEF and IRG troops in Ataq city escalated into a pitched battle, which the IRG won as reinforcements from Marib overwhelmed the SEF troops. They were relocated to Aden and gradually disbanded over the next few years.

However, in September 2021, Houthi forces re-entered the north of the governorate for the first time since 2017, retaking Bayhan, Usaylan, and al-Ain as part of a sustained offensive in southern Marib and eastern al-Bayda. The sudden Houthi advances and the heightening infighting within the IRG exacerbated local division in Shabwa, where worsening local conditions sparked tribal protests that led to the dismissal of Governor bin Adyu and his replacement by the UAE-backed tribal leader Awad al-Awlaki.

This helped facilitate the redeployment of the Giants Brigades from the West Coast to Shabwa. In January 2022, they launched Operation Southern Cyclone, swiftly retaking the northern districts in the span of 10 days and advancing into Marib, where they established new units to maintain a defensive line to avert any future Houthi attacks. Tensions, though, remained in Shabwa, and despite the formation of the power-sharing Presidential Leadership Council (PLC) in April, the infighting continued, peaking in August after al-Awlaqi sacked senior Islah-affiliated commanders.6Al-Ayyam, ‘The Governor of Shabwa dismisses ‘Lakkab’ and his office manager, Baoum continues to be detained,’ 7 August 2022 This time, the STC forces were victorious in the second battle of Ataq, ousting their rivals from the north and center of the governorate.

Since the STC-backed forces regained control of the governorate, infighting between the parties has declined. But, this coincided with an uptick in AQAP attacks in southern Shabwa and the bordering areas in Abyan. In response, the Shabwa Defense Forces (SDF), which had replaced the now-disbanded SEF, launched a new counter-terrorism operation, Southern Arrow, in September 2022 to clear the militants from the southeastern district of al-Musaynia. AQAP activity subsequently declined throughout the year before increasing again in mid-2023 as the group carried out drone, mortar, and IED attacks on the SDF. A steady stream of incidents continued into 2024, but hostilities also began to pick up on the governorate’s northern borders with Marib and al-Baydha, where a buildup of Houthi forces has led to an increase in confrontations between the group and pro-STC forces.

Timeline

- 2015

- Apr. | Houthi forces seize Ataq

- 2015

- Aug. | Houthi forces push into northern Bayhan and Usaylan

- 2016

- Aug. | The UAE establishes the Shabwa Elite Force

- 2017

- Dec. | IRG forces retake all of Shabwa

- 2018

- Jan. | Deadly AQAP attack on Shabwa Elite Forces provokes counter-terrorism operation that pushes group into al-Bayda

- 2019-21

- The Shabwani Elite Forces are gradually disbanded

- 2022

- The Shabwa Defense Forces are established

- Jan. | Operation Southern Cyclone clears Houthis from northern Shabwa

- Sep. | Counter-terrorism Operation Southern Arrow begins after a resurgence in AQAP attacks in southwestern Shabwa

- Oct. | Houthi drones hit Bir Ali port, shutting down oil exports

- 2024

- Jan. | Houthi forces build up their presence on the borders of Bayhan, leading to increased hostilities with pro-STC forces

Regional Context

Shabwa is the third largest oil-producing governorate in Yemen, which has been the primary source of revenue for the local authorities. At its peak, production reached 70,000 BPD in 2010 before dropping the following year during the youth uprisings that led to the resignation of President Ali Abdullah Saleh.7Casey Coombs and Majd Ibrahim, ‘Recovering Lost Ground in Shabwa’s Oil Sector,’ Sana’a Centre For Strategic Studies, 24 August 2023, p. 9 Output has since been disrupted by the conflict, halting in 2015 following the start of the Saudi-led Coalition’s military intervention. Production resumed in April 2018 at significantly reduced levels,8MEED, ‘Austrian firm boosts Yemen oil production,’ 20 November 2018 but stopped once more in November 2022 after Houthi drones struck the Bir Ali and Qana ports on the south coast and is yet to resume.

The governorate is also central to the export of the country’s natural gas reserves, which are extracted in neighboring Marib and then piped to the LNG terminal in the port town of Balhaf in Rudum district, a US$4.5 billion processing and export facility that first opened in 2009. The site also closed at the start of the conflict and has since 2017 reportedly been used as a military base for Emirati forces and affiliated units.9Louis Imbert, ‘A Total site used as a prison in Yemen,’ Le Monde, 8 November 2019

Plans to restart operations were aborted following the Houthi drone attacks. The incidents had been preceded by threats from the group warning against restarting operations at Balhaf until revenues were shared with them. While speaking at a conference in September 2022, PLC head Rashad al-Alimi claimed that French producer TOTAL, which leads an international consortium operating the facility, had sought security arrangements to prevent a possible Houthi missile strike on the facility should exports resume.10Middle East Institute, ‘His Excellency Rashad al-Alimi of the Republic of Yemen,’ 23 September 2022 Then, on 25 September, French Ambassador to Yemen Jean-Marie Safa traveled to al-Mukalla city where he held meetings with the local authorities, allegedly focusing on ways to secure Balhaf and mitigate the Houthis from targeting the facility.11Yemen News Portal, ‘France moves its forces to Mukalla for fear of being targeted in Balhaf,’ 25 September 2022